Month: February 2017

Emerging Trends in Bitcoin Regulation

Bitcoin, which appeared on the world stage in 2008, is a multi-faceted phenomenon: it is a technology, a currency, an investment vehicle and it has created a community of users. And, like many fintech (financial technology) innovations over the last decade, the Bitcoin digital currency has provided a disruptive alternative to traditional currency-based financial methods and institutions.

A Bitcoin Primer

In a nutshell, Bitcoin is a peer-to-peer system for online payments & transactions that does not require a trusted central authority such as PayPal, banks, credit card companies, etc. The various elements that, together, comprise the Bitcoin protocol are [1] [2] [3]:

- Programmers – who donate their time developing the open-source Bitcoin software (subject to approval of lead developer Gavin Andresen).

- Users (“miners”) – who install the Bitcoin software and pool their computers’ processing power to verify and process a transaction by solving complex math problems. New Bitcoins enter circulation as “miner” rewards that are proportional to the computing power they donate to the network in creating a “block”, i.e. an encrypted Bitcoin transaction. NOTE: In order to slow down the rate at which new Bitcoins are introduced, the math problems become increasingly harder and the rewards are cut in half at regular intervals.

- The block chain – a shared public ledger that includes all confirmed transactions. The integrity and chronological order of the block chain is enforced through cryptography.

- Private keys – a secret piece of data used to sign a transaction between Bitcoin wallets. They are critical to providing proof that the Bitcoin being offered is legitimately owned and to ensuring a transaction cannot be altered once it has been issued.

These checks and balances make it virtually impossible for anyone to manipulate the Bitcoin system.

The Growing and Enduring Impact of Bitcoin

Bitcoin can either be used to buy things online from a growing list of merchants and organizations that accept Bitcoin, or it can be cashed through an exchange, broker, or direct buyer.[3] From the outset, a built-in limit of 21 million Bitcoins was established and as of early January 2017, about 16 million Bitcoins were in circulation. As shown in the graph below (based on two of the major Bitcoin online exchanges), the Bitcoin price has more than doubled from $394 on January 27, 2016 to $896 on January 25, 2017. When the price peaked in early January at around $1,130, the Bitcoin market cap was $17.56 billion.

As can be expected, other crypto-currencies have been launched to compete with Bitcoin. Key players, however, predict that as long as Bitcoin continues to remain a robust, dynamic open software platform, it will likely remain the leader since the cost of migrating miners to other competing technologies would be very high.[5]

As can be expected, other crypto-currencies have been launched to compete with Bitcoin. Key players, however, predict that as long as Bitcoin continues to remain a robust, dynamic open software platform, it will likely remain the leader since the cost of migrating miners to other competing technologies would be very high.[5]

Managing Bitcoin Abuse

Because Bitcoin transactions are done using public keys, the identities of the buyers and sellers are unknown to each other and to the public. In addition, Bitcoin transactions cut out middlemen like banks or clearinghouses. Although this significantly reduces the cost, duration and complexity of global transfers, these same middlemen also play an important regulatory role in preventing illicit activities such as money laundering and tax evasion.[3]

Given the fact that Bitcoin (and other crypto-currencies) are here to stay and given Bitcoin’s inherently unregulated and pseudonymous nature, regulators and law enforcement officials are seeking innovative ways to reduce the risk of abuse. Thus, for example, last week (16-18 January 2017) 400 participants from law enforcement agencies and private industries from 60 countries gathered in Qatar for the Digital Currencies & Money Laundering conferenced hosted by INTERPOL.

As noted by Tim Morris, INTERPOL’s director of Police Service “Digital currencies are not constrained by national regulations or borders, therefore cooperation in fighting against criminal uses of digital currencies must also transcend borders and integrate solutions from both law enforcement and private sector.”[6]

In October 2015, the European Union took the important step of harmonizing the tax treatment of Bitcoin transactions, since Bitcoin was considered digital money in some countries and a commodity in others. And earlier this month, the European Parliament proposed a directive that would require crypto-currency exchanges and wallets to identify suspicious activity as part of the general directive on preventing money laundering and terrorist financing.[7]

A first regulatory response in the US was New York’s BitLicense that was adopted in June 2015. BitLicense aims to regulate virtual currencies by regulating the Bitcoin commercial operators as if they were regular financial operators or money transmitters – requiring them to comply with anti-money laundering, know-your-customer, and other money transmission laws and regulations.

Finding the Regulatory Balance: An Ongoing Effort

Recently Coinbase, a prominent digital asset exchange company, was served a subpoena by the IRS to disclose records on all its US customers. Coinbase’s response is that seeking transaction information on so many customers only because they use virtual currency is a violation of their privacy. If the IRS were to approach PayPal, Fidelity or Citibank with such a request, those companies would rightfully object. At the same time, however, Coinbase is fully and publicly committed to complying with tax reporting requirements and has suggested solutions such as issuing an annual summary of digital asset trading gains and losses rather than extensive transaction records.

The ongoing challenge will be to figure out how to regulate Bitcoin in a way that does not impinge upon the benefits that blockchain technologies provide in terms of efficiency, transparency, accountability and consumer protection.

References

[3] Rebecca Grant, Bitcoin for Idiots, Venture Beat, February 17, 2014

[4] Samburaj Das, Bitcoin’s Market Cap Crosses $17.5 Billion, January 4, 2017

[5] Javier Hasse, 2017: The State of Cryptocurrencies (Part 2), Benzinga, January 24, 2017

[6] Samburaj Das, INTERPOL Hosts Digital Currencies & Money Laundering Conference in Qatar, 20/01/2017

[7] Lester Coleman, BBVA Economist: Legal Framework Needed for Blockchain Technology, January 15, 2017

[8] Primavera De Filippi, We Must Regulate Bitcoin. Problem Is, We Don’t Understand It, March 1, 2016

[9] Lester Coleman, Coinbase CEO Asks IRS to Work Together toward Mutual Goals, January 17, 2017

Get the latest insights delivered to your inbox

Global Corruption and FCPA Enforcement Actions on the Rise

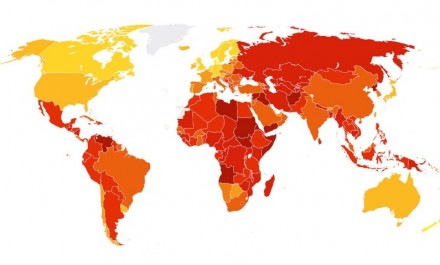

Transparency International recently released its much anticipated Corruption Perceptions Index for 2016. This global index ranks countries by their perceived levels of corruption, on a scale of 0 (highly corrupt) to 100 (very clean). According to the Index, “More countries declined than improved in this year’s results, showing the urgent need for committed action to thwart corruption.”

With global corruption on the rise and a call for increased anti-corruption enforcement, it’s important to know where business practices are corrupt and how that could affect you. Out of 176 countries and territories measured in the Index, here are the top and bottom 10 countries (with their perceived level of corruption in parenthesis).

Top 10: Least Corrupt Countries

- Denmark (90)

- New Zealand (90)

- Finland (89)

- Sweden (88)

- Switzerland (86)

- Norway (85)

- Singapore (84)

- Netherlands (83)

- Canada (82)

- Germany (81)

Bottom 10: Most Corrupt Countries

- Venezuela (17)

- Guinea-Bissau (16)

- Afghanistan (15)

- Libya (14)

- Sudan (14)

- Yemen (14)

- Syria (13)

- North Korea (12)

- South Sudan (11)

- Somalia (10)

Following a year of increased global corruption, it’s not surprising that the first month of 2017 was the busiest January ever for an FCPA (Foreign Corrupt Practices Act) crackdown, with federal enforcement increasingly on the lookout for American companies engaging in corrupt practices overseas. Called an “FCPA enforcement blowout” by the FCPA Blog, this January saw six companies pay a combined total of more than $250 million to settle FCPA-related offenses – and it’s not just companies being called to task. Seven individuals were also part of the enforcement blowout: two plead guilty, three were indicted by the DOJ and two were charged by the SEC – all for various acts of corruption abroad.

To protect your business in this heightened era of corruption awareness, it’s critical to comply with far-reaching FCPA anti-bribery and corruption requirements. U.S. companies with offices or employees located overseas must provide those workers with compliance training programs that explain FCPA rules and obligations in their native language. Accurate translations and a commitment to compliance are key parts of maintaining a corruption-free global workforce.

Distributing English-only policies instead of professional translations can seriously backfire if any bribery or corrupt behavior takes place abroad. As we’ve seen from the first few weeks of the new year, non-compliance with the FCPA can be very bad for business.

Your best bet is to provide appropriate FCPA compliance training during the onboarding process – especially if you’re doing business in any of the countries categorized as high risk by the 2016 Corruption Perceptions Index. To ensure employees’ full comprehension, provide this information in a legally binding document in their native language.

Get the latest insights delivered to your inbox

Man v. Machine: Four Factors to Consider in eDiscovery Translation

Printed documents, video cassettes, CDs and even paper business cards are quickly becoming souvenirs of the past. In today’s digital world, more and more small businesses, corporations and governments are storing their data electronically. In the legal field, this means whole new categories of information to comb through as part of the eDiscovery process. Electronic data can include, but is not limited to: emails, documents, presentations, databases, voicemails, audio and video files, social media and other websites…from various electronic devices, all over the world and in multiple languages.

Identifying and collecting relevant documents during eDiscovery can produce crucial information for your case, but what if it is discovered in a foreign language? In such cases, you will need to consider these four factors to determine how to proceed with your translation needs:

- TIME – If you’re working on a deadline with hundreds of documents to translate, machine translation will give you the “gist” of each document, however it is likely this will only highlight which ones need further human review and translation.

- COST – Human translation is far more accurate and reliable than machine translation, but costs more and takes longer to produce results than machine translation.

- ACCURACY – For technical and legal documents, full human translation will always provide the most accurate results. However, a combination of machine translation followed by human post-editing is usually less expensive and the quality may be sufficient to meet your needs, especially for documents that do not need to be submitted in court.

- CONFIDENTIALITY – Human translators sign confidentiality agreements upon hiring, but many machine translation services do not guarantee confidentiality for the data you upload.

Every eDiscovery translation project is unique; you will never find a one-size-fits-all solution. It’s all about striking the right balance between accuracy, cost and speed. Generally speaking, human translation provides the highest level of accuracy and quality but is more expensive and takes longer to produce results than MT or MT with human post-editing. But a combination of human translation with machine translation can produce quality sufficient to meet your needs, especially if time and budget are limited. If you require translation of foreign language documents during eDiscovery, contact Morningside about tailoring a custom solution that takes your budget, timeframe and confidentiality needs into account to produce the best possible results.

Get the latest insights delivered to your inbox

The Trans-Pacific Partnership is Officially Dead

On his first day in office, President Trump followed through on his campaign promise to withdraw from the Trans-Pacific Partnership (TPP), with the goal of preventing jobs from being outsourced overseas. “We’re going to stop the ridiculous trade deals that have taken everybody out of our country and taken companies out of our country, and it’s going to be reversed,” said Trump to union leaders at a White House meeting after the official withdrawal.

Though it was never ratified by Congress, the Obama administration worked with 11 other signatory countries for more than two years to shape the massive free trade deal, which aimed to eventually unite the 12 Pacific Rim countries (including the US) in an EU-like single market – a market which Trump says would have hurt American workers and undercut American companies due to the influx of cheap labor available tariff-free from other countries in the pact.

On the other hand, American innovators would have greatly benefited from the significant increases in protection that the TPP offered for patents, trademarks, copyrights and trade secrets. In fact, some have argued that the primary beneficiaries of the TPP would have been holders of intellectual property rights and that the benefits to everyone else were unclear.

Now that U.S. participation is off the table, the other TPP countries will have to decide whether to move forward without it. Australia and New Zealand said they hope to salvage the deal by bringing on new partners like China and other countries in Asia. “Losing the United States from the TPP is a big loss, there is no question about that. But we are not about to walk away,” Australian Prime Minister Malcolm Turnbull said to reporters on Tuesday (Jan. 24).

The big question now for IP is what will happen next, and how will intellectual property rights be effected by the various new bilateral trade agreements that the Trump administration plans to pursue in place of the TPP? To read more about this and other TPP intellectual property issues, check out our recent article in IP Watchdog.

Get the latest insights delivered to your inbox

CE Marking: Passport to Medical Device Success in Europe

With a total annual healthcare spend of $1.94 trillion, access to the EU healthcare market is crucial to success in the medical devices field. But in order to access this critical market, you will need to obtain a CE Mark.

The CE Mark is printed on all products that meet EU health, safety and environmental requirements. In order to gain CE Marking for your product, the recently updated Medical Device Regulations (MDR) state that “information… must be made available to the user and the patient…in their national language(s) or in another Community language… regardless of whether it is for professional or patient use.” The updated regulations come into effect beginning in 2017 and will work to ensure that all competent authorities, professional distributors and patients understand how to properly use medical devices and the risks involved in their native language.

In order to market your devices in the EU under the new regulations, you must convince the competent authority in each country where you wish to sell your product of the clinically-relevant safety and efficacy data for each of your treatment’s indications. This mandatory data is typically found in three documents: Instructions for Use (IFU), Labeling and Packaging information. However, you may also be asked to provide the UI and software package, marketing materials or patient/caregiver details, depending on the complexity and nature of your device.

As a rule of thumb, translations for competent authorities typically involve at least one of the “Big 5” languages: German, Italian, Spanish, French and English. Translating your required materials into each of these languages should be a priority when preparing your CE Mark application.

High quality medical translations are your insurance for achieving future regulatory approval, a smooth sales process and low-risk adoption of your treatment among end users. Low quality translations put your product, patients and reputation at risk. Mitigate the risk by partnering with an ISO-certified Language Service Provider (LSP) like Morningside to translate medical documents required for obtaining a CE Mark.

About the Author:

Jack Fischer is a Business Development Manager at Morningside’s Life Sciences division. After researching Tuberculosis genetics at Albert Einstein College of Medicine, and working with numerous biotechnology startups in New York, Jack moved to Morningside in order to apply his expertise to developing and implementing translation solutions for the life sciences industry. Jack has a dual B.A from Skidmore College in Integrative Biology & Business.